The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Ontario energy credit windows.

Like that other credit the amount you can get back is still 30 with a decline until the tax credit expires after 2021.

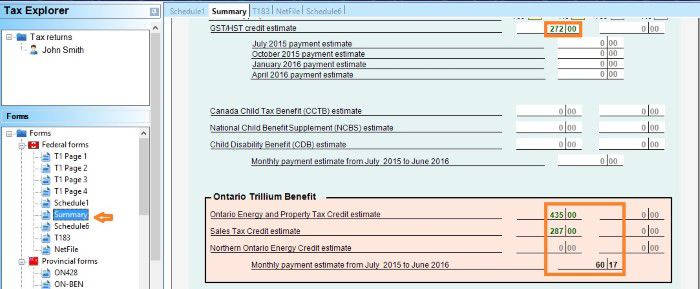

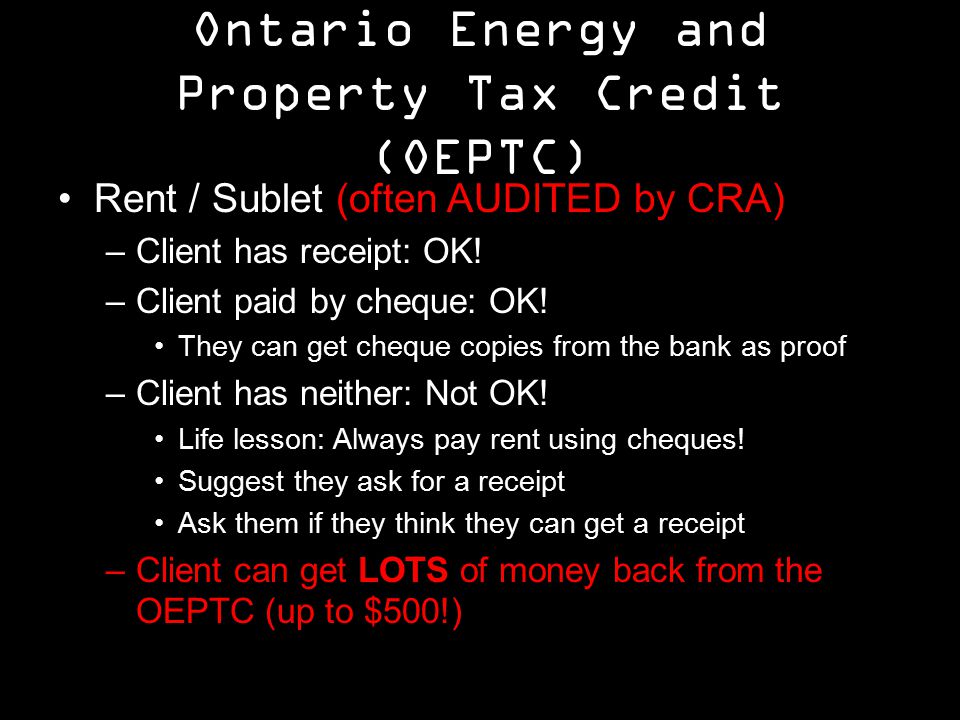

The annual entitlement is usually divided by 12 and issued monthly as part of the ontario trillium benefit otb payment see first three bullets of the note.

The tax credit is an extension of the 26 u s c.

25c tax credit which means all previous federal tax credits are a lifetime maximum credit.

You could deduct 100 of energy related property costs but this portion of the credit had a maximum lifetime limit of 500 you couldn t claim 500 per year.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

This includes the solar energy tax credit.

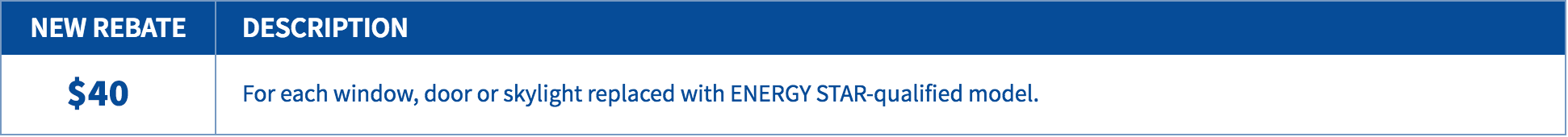

The credit for home insulation exterior doors certain roofing materials and exterior windows and skylights was just 10 of the cost.

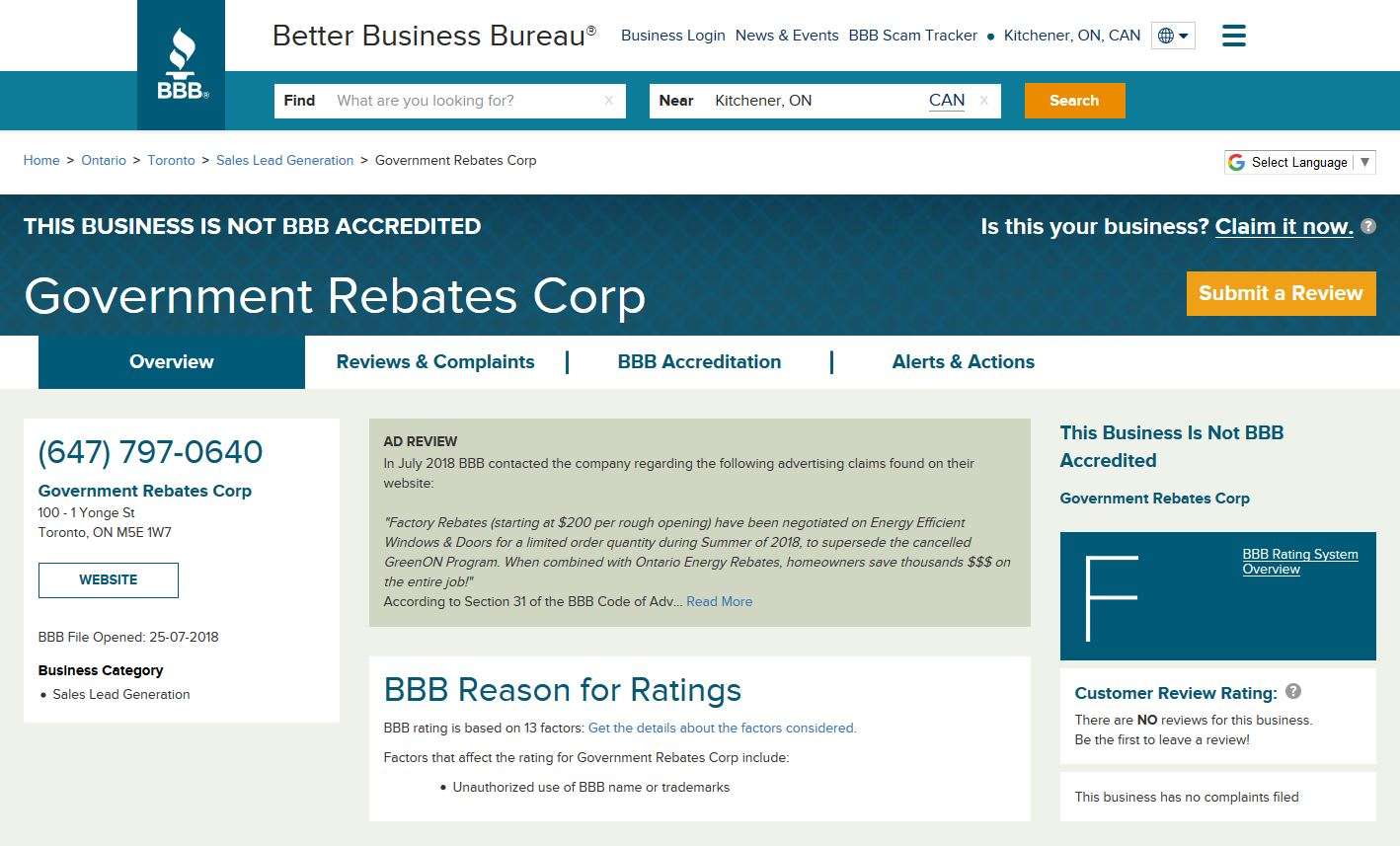

What is the ontario energy and property tax credit oeptc.

The nfrc label provides a reliable way to determine a window s energy properties and to compare products.

This wasn t a particularly generous tax credit.

200 for eligible windows and skylights.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

If a combination of windows skylights and doors are purchased then the total maximum credit is 500 of which 200 is the maximum allowable for windows and skylights 5.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

Claim the credits by filing form 5695 with your tax return.

You will add up your various energy credits on irs form 5965.

If you claimed an energy efficiency credit in a previous taxable year please consult a tax professional or visit www irs gov to determine your remaining eligibility for this credit.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

The ontario energy and property tax credit is one of the three credits that make up the ontario trillium benefit.

Federal tax credits for windows is one of the more prominent tax credits offered as well as one of the most overlooked tax credits by homeowners.

The oeptc is designed to help low to moderate income ontario residents with the sales tax on energy and with property taxes.

Homeowners may receive no more than 500 total for all energy efficiency tax credits.

The national fenestration rating council nfrc operates a voluntary program that tests certifies and labels windows doors and skylights based on their energy performance ratings.

The renewable energy tax credit is for solar geothermal and wind energy installments and improvements.

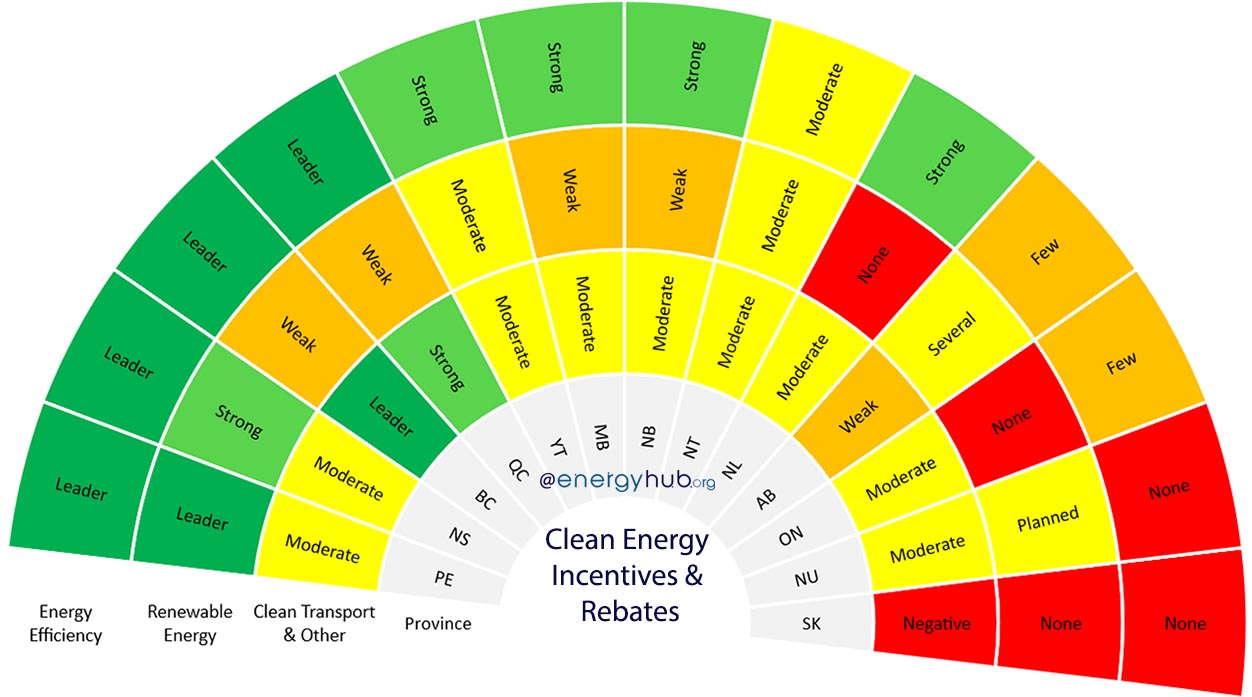

Federal income tax credits and other incentives for energy efficiency.