Oaktree capital has issued three separate fillings for its eleventh fund with two of them looking to be supporting capital raises.

Oaktree capital energy fund.

We have originated and financed over seventy transactions in the energy and power industries.

Our investment decision process our core investment and portfolio management team and our priorities remain the same since we made our first investment in 1995.

Oaktree capital management llc is planning a new distressed debt fund as recent credit market turmoil throws up investment opportunities.

Oaktree specialty lending corporation nasdaq ocsl oaktree specialty lending is a specialty finance company that seeks to generate current income and capital appreciation for investors.

Non oaktree employee power opportunities gfi energy group los angeles.

Oaktree s infrastructure strategies seek to make investments primarily in north american real assets and infrastructure related businesses in the energy and transportation sectors.

The firm was formed in 1995 by a group of individuals who had been investing together since the mid 1980s in high yield bonds convertible securities distressed debt real estate control investments and listed equities.

Distressed asset manager oaktree capital management is looking to raise 15 billion for a distressed fund two people familiar with the matter said on wednesday.

Oaktree opportunities fund xi oaktree opportunities fund xi parallel and oaktree opportunities fund xi feeder cayman.

Ian schapiro managing director and co portfolio manager michael cardito managing director and co portfolio manager jason lee managing director and co portfolio manager peter jonna managing director jimmy lee managing director ulysses fowler senior vice president.

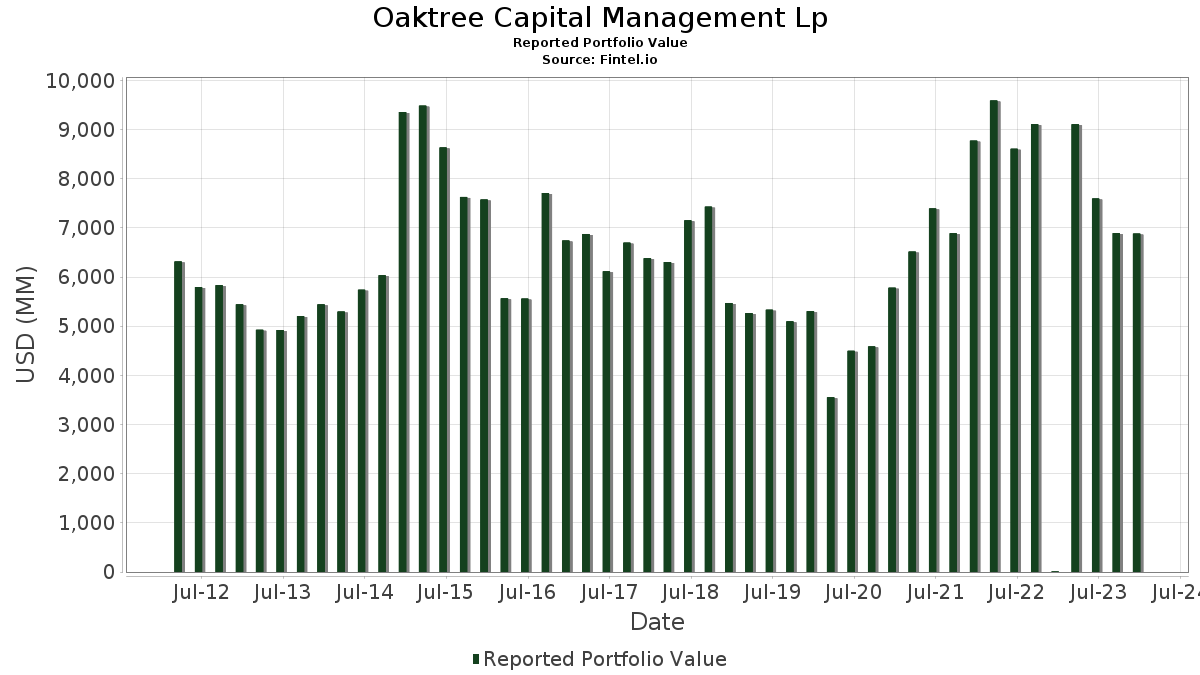

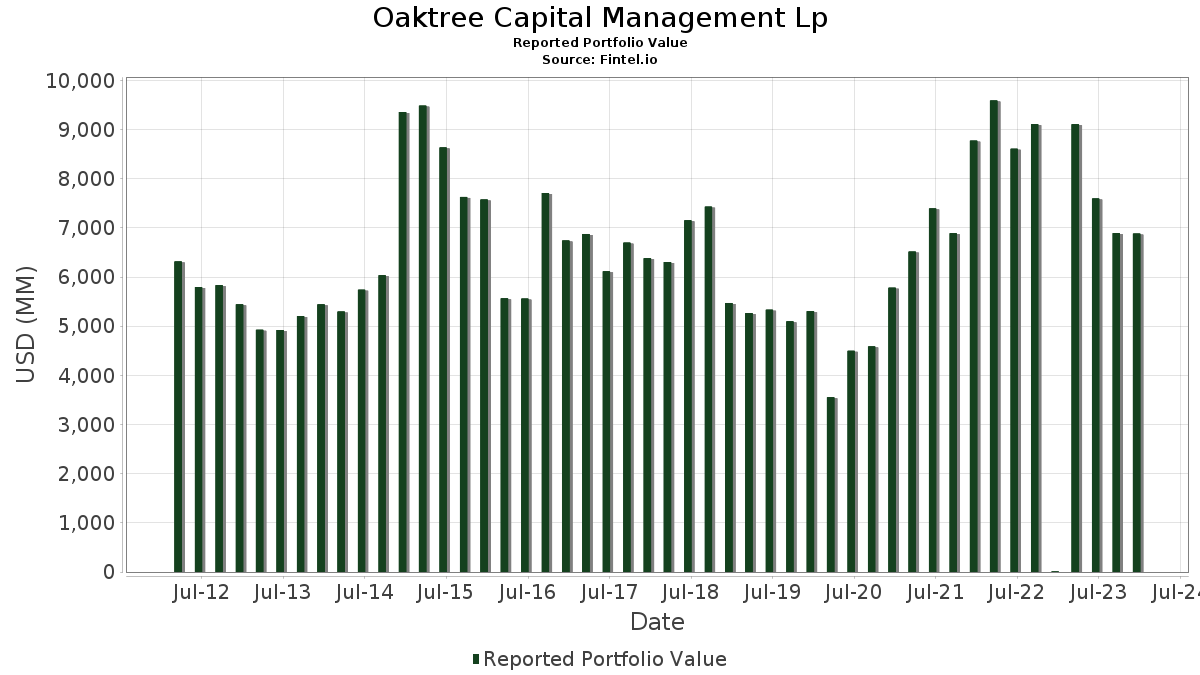

Oaktree capital management is a leading global alternative investment management firm with expertise in credit strategies.

Pursuing the ultimate objective of investment success the fruits of which are shared by oaktree clients and personnel.

There are four primary strategies.

These investments represent over 3 billion in equity capital.

Oaktree has its original roots in high yielding and distressed credit debt although today invests across the spectrum from equity to debt.

Oaktree capital is one of the world s leading alternative investment managers.