The ontario energy and property tax credit is a personal tax credit funded by the province of ontario and implemented to help individuals with low to moderate income with the sales tax on energy as well as their property taxes.

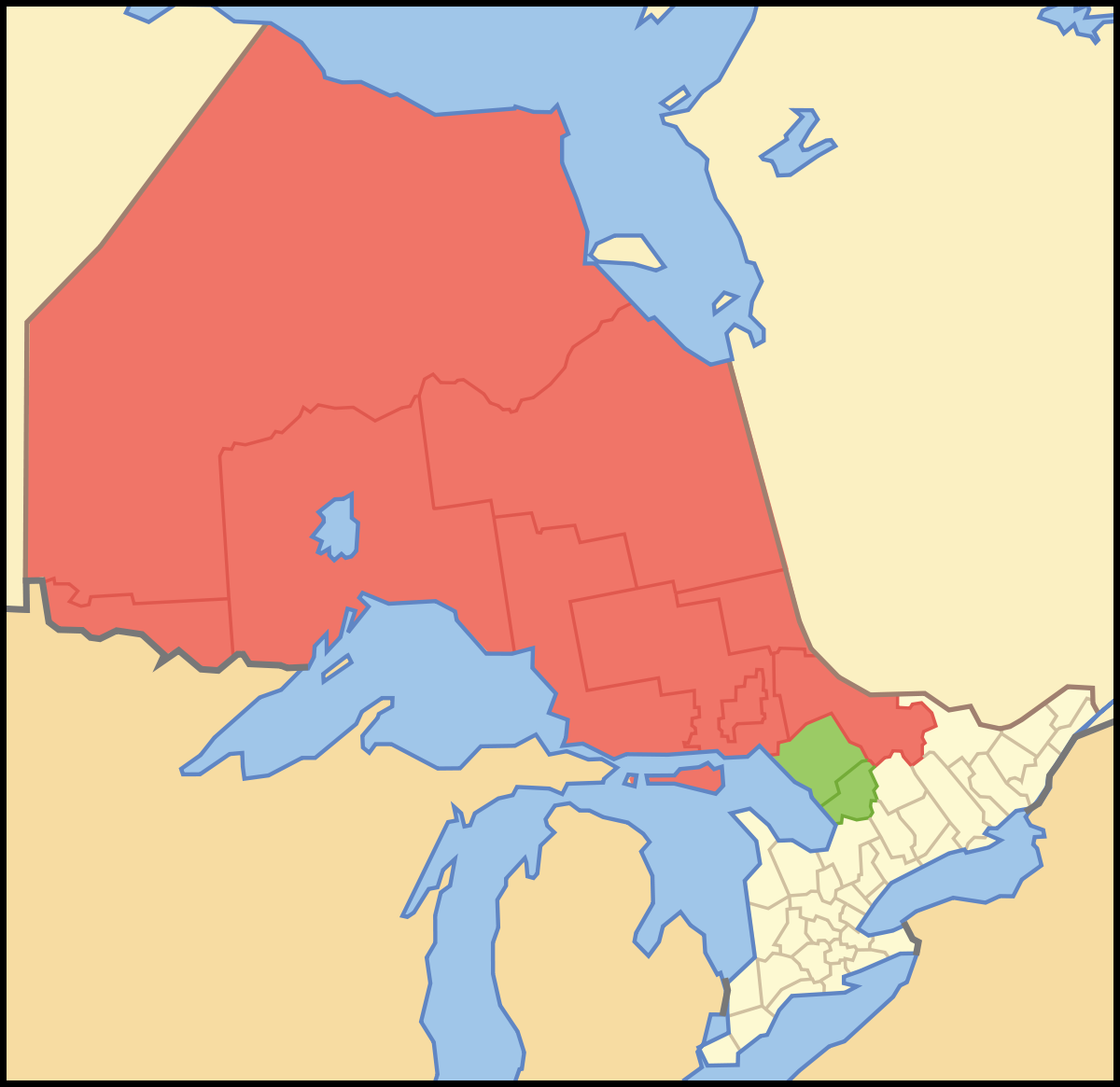

Northern ontario energy credit map.

The annual entitlement is usually divided by 12 and issued monthly as part of the ontario trillium benefit otb payment see first two bullets of the.

The northern ontario energy credit would help over half of northerners benefit from about 35 million in assistance in 2010 alone dwight duncan minister of finance.

Steps to get this rebate.

You must be a resident of northern ontario at the beginning of a month to receive that month s.

You apply for the credit by completing the on ben form which.

As of july 2012 the noec will be paid monthly as part of the ontario trillium benefit.

Up to 227 who is eligible.

The ontario energy and property tax credit is one of the three credits that make up the ontario trillium benefit.

The credit is part of the ontario trillium benefit.

What is the northern ontario energy credit noec.

The northern ontario energy credit noec helps low to moderate income northern ontario residents with the higher energy costs the face living in the north.

This credit helps northern ontario residents with the higher energy costs they face living in the north.

Northern ontario residents description.